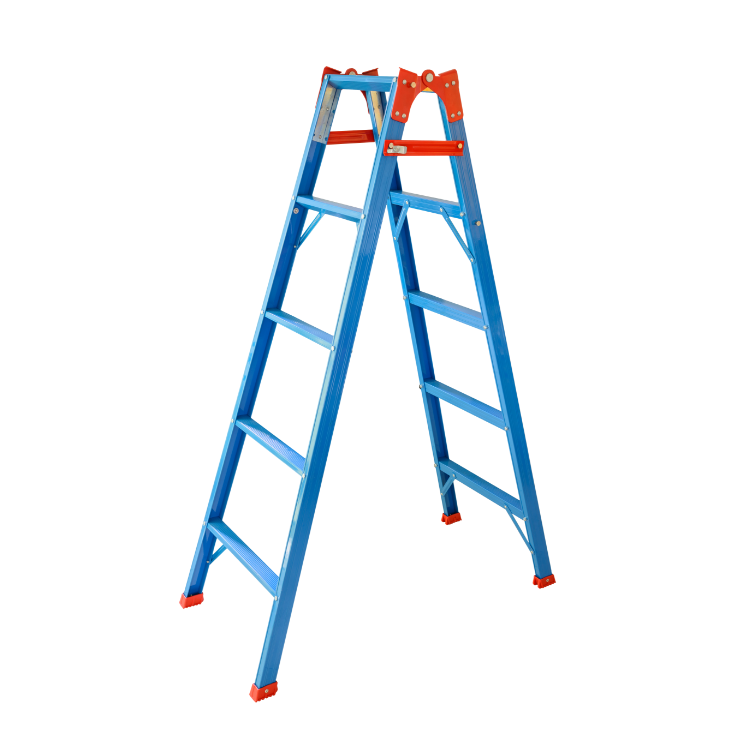

With three main types of household insurance, it may seem confusing. It’s actually quite straightforward. There is buildings insurance which protects your home itself, the materials it comprises, such as the roof, walls, windows and fixtures – a fitted kitchen or garage, for example. Then there is contents insurance, which typically covers items that can be carried out of your home, including soft furnishings, white goods, furniture – even your freezer contents. And the third type is a combination of both.

Protecting your home, inside out

Protect your home and personal belongings with comprehensive home insurance. For financial protection and peace of mind. We are here for you in your hour of need and for the everyday.

Contact our team today to see how we’ve got you covered.

Get in touch

Get in touch

Personalised, straightforward home insurance

Whatever you need to protect and whatever the level of cover, at James Leighton, we help you find the most suitable home insurance for you. Our insurance services are personalised and with a wide range of options available, we work with you to establish what the most appropriate cover would be. We make the process simple and efficient by listening to your needs and taking care to explain our recommended options with clarity so you have a good understanding of the suggested cover. We will support throughout the process and beyond if you have any questions.

- Call: 0115 870 9520

- Email: [email protected]

-

Wide range of options

At James Leighton, we can offer you advice on buildings, contents and combined insurance. What you need will depend on several factors, including your property type, its value and your needs.

-

Access to trusted providers

At James Leighton, we only work with 5-star Defaqto insurance providers who are available exclusively to mortgage brokers. Our advisers can compare your current policy in an instant to see if we can get you a more advantageous deal or a more suitable level of cover.

-

Flexible add-ons

We are able to offer optional extras, such as accidental damage, high-value items, home emergency and family legal expenses – depending on your own individual needs. So, you can adapt your cover to suit your lifestyle and home.

-

Hassle-free setup

We aim to make securing home insurance as smooth and stress-free as possible. With our efficient service, you can get a quote, review your options and put your cover in place quickly – all without the paperwork headache.

Personalised advice

At James Leighton, we don’t believe in one-size-fits-all solutions. Our advisers ensure your home insurance reflects your property, possessions and peace of mind.

Is your home underinsured?

Underestimating the cost to rebuild your home or property or the value of its contents is a risky business.

If you have to make a claim and the payout doesn’t cover the full cost of repairs or loss you will need to make up the shortfall. The last thing you will want to hear is that you aren’t covered in full. It is hard enough having to deal with the loss of, or damage to, your home but to then be faced with the reality that you may need to contribute thousands to rebuild it, is thankfully an avoidable hardship.

Do you work from home?

Today, with an increasing number of us working from home, this matter affects more of us than ever before. Even if you work from home only sometimes, it is worth considering the impact this could have on the likelihood of you needing to make a claim.

From request to purchase, our advisers will be there

At James Leighton, we support all our clients, guiding them as they select the home insurance that suits them and their needs. We get to know each client and their individual circumstances so we can suggest the appropriate level of cover for them. Known for our outstanding service, our easy to reach team comprises dedicated, committed advisers and administrators who aim to make the whole process as seamless as possible for you.

FAQs

Q

What’s the difference between buildings and contents insurance and home insurance?

A

Q

Can I switch providers mid-policy?

A

Yes, you are able to switch your home insurance provider at any time and the insurers we use do not charge cancellation fees.

Q

What does home insurance typically not cover?

A

Generally, standard home insurance does not cover damage that has been caused by vermin (unless you have Home Emergency cover) or general wear and tear. And generally, it won’t cover any of your belongings that are lost, stolen or damaged while you – and they – are not at home. There is additional cover you can take out for this.

13%

is how much the average payout per home insurance claim rose by in Q2 2024.

According to the Association of British Insurers (ABI), this is a record high, making the average payout £6,002 per home insurance claim.

What our customers say

Kept us up to date with the whole process and have been so helpful! Would definitely recommend.