You can buy between 10% and 75% of any home. However, the property must be owned by an approved not-for-profit housing association whose main aim is to supply housing. They’ll own the rest of the property and you’ll need to pay them rent.

The lowdown on Shared Ownership

To understand Shared Ownership and get the most suitable deals you need an experienced Shared Ownership mortgage broker who specialises in this field.

Contact a James Leighton adviser today to find out if a Shared Ownership mortgage is the right option for you.

Get in touch

Get in touch

Specialist help at your fingertips

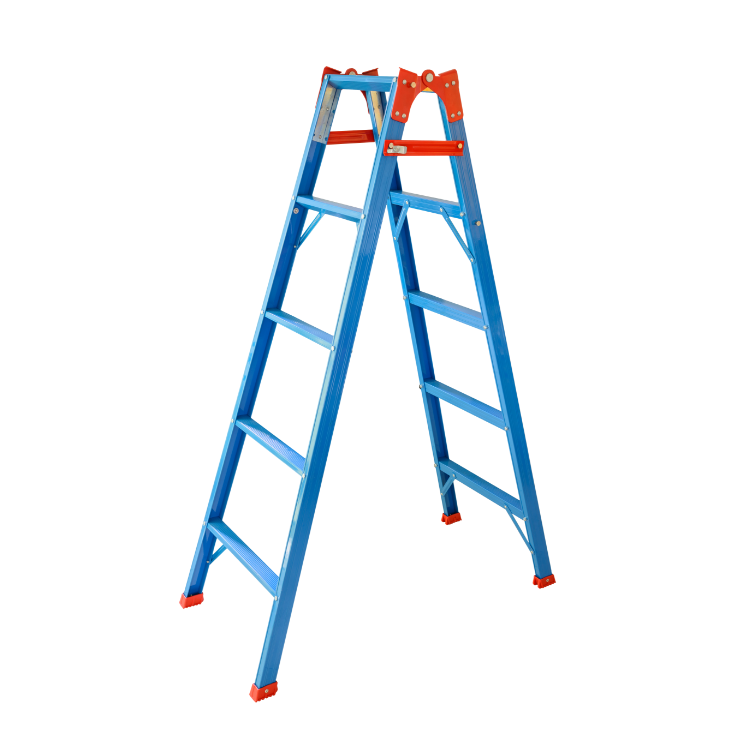

House price increases, lower loan values and the cost-of-living crisis are making Shared Ownership the only option for many first-time buyers. With Shared Ownership, you’ll be effectively part-buying and part-renting your property.

It can seem impossible to get on the property ladder. That’s where we step in. We’re specialists in mortgages for Shared Ownership. We can assess your current finances, advise on your mortgage options and negotiate with the housing association when applicable.

We advise on variable-rate mortgages, fixed rates, trackers, discount and even some interest-only options (although it's less likely a housing association will accept interest-only). Our professional, qualified and experienced Shared Ownership mortgage advisers will help you through each step of the process.

- Call: 0115 870 9520

- Email: [email protected]

-

Variable

The variable-rate mortgage uses an interest rate set by the mortgage lender. The rates will change in accordance with the terms of the mortgage. This can be annually or even monthly. Most trackers and fixed-rate mortgages will switch to these after their favourable terms expire.

-

Fixed

Fixed-rate mortgages will have a set interest rate for a defined period. They provide certainty as you’ll always know what you need to pay, regardless of whether the general interest rate rises or falls.

-

Tracker

Tracker mortgages follow a base rate which is usually the Bank of England interest rate. They’ll be a set percentage above the interest rate and will move up and down as the interest rate does. Your Shared Ownership mortgage rate, and therefore payment, will change every time the Bank of England interest rate changes.

-

Discount

Discount mortgages are designed to help affordability in the early years. They will be a specific percentage below the variable rate. The rate is normally set for between two and five years. After that, you’ll switch to the standard variable rate. It can help you afford the mortgage on your Shared Ownership property.

Interest-only

This is rare for Shared Ownership properties as the housing association will need to approve it. The mortgage payment effectively clears just the interest on your mortgage, leaving the lump sum due at some point in the future. For a housing association to agree to this you’ll need a 50% deposit and a plan to repay the lump sum.

How do I decide on a Shared Ownership mortgage?

Most Shared Ownership mortgages are fixed-rate as the certainty is beneficial for your first step on the property ladder. However, this isn’t a one-size-fits-all scenario. You need proper advice, ideally from someone who acts as a whole of market mortgage adviser. Our advisers are just that and ready to help you.

Required earning levels

You don’t need a minimum income to qualify for a Shared Ownership mortgage, however you do need good credit and enough income to cover rent, mortgage and the associated bills. Lenders use an affordability calculator to decide this. We can help you find the lender that will offer the amount you need based on your affordability calculator.

Future prospects

You can pay your mortgage off and continue paying rent on the rest of the property. However, with careful financial planning, you can also purchase the shared part of your home. Our specialist team can help you understand your options and build a strong financial plan.

How we can help you choose

Here at James Leighton, we offer a personalised bespoke service to all of our clients. We care about you and your needs and will work with you through every step of the process. Our aim is to help you get the most advantageous deal possible and move into the Shared Ownership property of your dreams. Our process starts with a meeting and a discussion of your personal finances. We’ll also want to know your long-term goals. This information will help us to provide you with your options. Best of all, we’ll describe everything in simple terms so you know exactly what you’re doing. Whether you're looking to buy your first home or remortgage for a Shared Ownership, we are here to help.

- Call: 0115 870 9520

- Email: [email protected]

FAQs

Q

How much of the property can I buy?

A

Q

Is there a pre-determined rent calculation?

A

Yes! The housing association which owns part of your home will charge a rent of 2.75% of the value of their share of your property. For example, if you have a 50% Shared Ownership of a £200,000 property then the housing association owns £100,000 of it. Their annual rent of 2.75% would be £2750 per year, or £229.16 a month.

Our specialist mortgage advisers can help you work out if you can afford the rent and your mortgage payment on the half you own.

Q

Can anyone use the Shared Ownership scheme?

A

The Shared Ownership scheme is only for first-time buyers, existing Shared Ownership homeowners looking to move and people who have previously owned a home but aren’t in a position financially to buy one now. Contact our team today to confirm your eligibility.

Q

What is a mortgage for Shared Ownership?

A

A Shared Ownership mortgage is a loan designed for purchasing a portion of a property while paying rent on the remaining share owned by a housing association.

Q

Can I remortgage for Shared Ownership?

A

Yes, you can remortgage for Shared Ownership to get a different or more suitable deal, release equity, or buy a larger share of your property.

Q

Do I need a Shared Ownership mortgage adviser?

A

A Shared Ownership mortgage adviser can guide you through the process, helping you find a mortgage suited to your circumstances.

Q

What deposit do I need for a Shared Ownership mortgage?

A

Deposits for Shared Ownership mortgages are typically between 5-10% of the share you are buying, rather than the full property value.

Q

Can I use a Shared Ownership mortgage broker?

A

A Shared Ownership mortgage broker can help you compare deals from multiple lenders and navigate any complexities involved in the application.

Q

How do I increase my share in a Shared Ownership property?

A

You can increase your share through staircasing, which involves buying additional portions of the property over time, often requiring a remortgage for shared ownership.

Q

Are there restrictions on selling a Shared Ownership property?

A

Yes, the housing association usually has the right to find a buyer first before you can sell on the open market.

Q

Can I get a Shared Ownership mortgage with bad credit?

A

Some lenders offer Shared Ownership mortgages to applicants with bad credit, but rates and eligibility criteria may be stricter.

76%

of Shared Ownership purchases are first-time buyers*.

Further, 69% of Shared Ownership properties have been bought by people under the age of 40 and 35% are under the age of 30.

What our customers say

Leanne Morris has been such an amazing advisor! She brings her very experienced knowledge and puts you first to give you the best possible outcome. The best I’ve ever come across! Thanks to Leanne, I have secured the best rate possible for me at the time and is always there if I need her for her very friendly advice and support.