In situations like this, there are many factors to consider, and you should seek guidance from a professional mortgage adviser to avoid paying unnecessary penalties. A mortgage adviser can help you weigh up the costs of porting and possibly topping up with your current lender against the potential benefits of changing to a new lender.

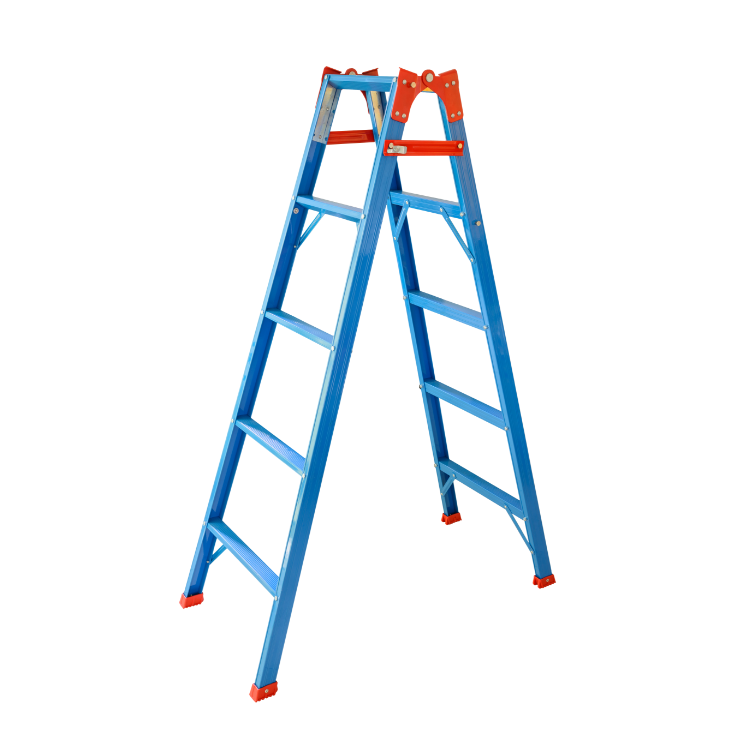

Home mover mortgages

Home mover mortgages help those buying a new home while selling their current one. This process can involve porting an existing mortgage, early repayment charges, and securing a new mortgage. Our Nottingham-based mortgage brokers can guide you through the steps, offering tailored advice to find the most suitable deal and manage the process.

Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it.

Contact our friendly team to discuss your planned move.

Get in touch

Get in touch

The James Leighton approach

Every client’s financial situation is different. That’s why we focus on clear communication at every stage of the mortgage process. From the first conversation, we take the time to understand your financial position, goals, and preferences. This allows us to provide personalised mortgage solutions that work for you. Our approach ensures an efficient, fee-free service that keeps things straightforward and stress-free.

- Call: 0115 870 9520

- Email: [email protected]

-

Access to a wide range of lenders

As a whole of market mortgage broker, we work with over 90 lenders and thousands of deals. We also have access to exclusive home mover mortgage products through our network, Quilter Financial Planning Limited, ensuring you get competitive options.

-

A fast and efficient mortgage process

Moving home is stressful enough. Our role is to make the mortgage side of things more manageable, providing professional support and an efficient application process.

-

Tailored advice on porting

If you’re considering porting your mortgage, we’ll assess whether it’s the most suitable move for you. Porting can save time and money, but we’ll explain the pros and cons based on your situation.

-

Trusted mortgage specialists

Our experienced brokers have helped thousands of home movers across the UK. With a strong reputation for professionalism and results, we’re a trusted choice for securing the most suitable mortgage.

Home move specialists

James Leighton mortgage advisers have decades of combined experience. We’ve already helped thousands of individuals and families make their move successfully.

Preparing for your move

A stress-free move starts with early planning. Our advisers can help at any stage—whether you’re preparing months in advance or need quick support. We’ll assess your borrowing potential, help maximise your deposit’s impact, calculate monthly repayments, and secure a Decision in Principle (DIP) so you’re ready to make an offer with confidence.

Resale or new build?

Resale and new build homes each have benefits and drawbacks. Our team can help you weigh the options and explore new build incentives like part exchange and assisted moves.

Budgeting and timing of costs

Beyond the mortgage itself, there are other costs to consider. We’ll help you budget for removals, stamp duty, legal fees, valuations, mortgage product fees, first payments, and insurance - so you’re fully prepared.

Professional guidance when you need it

Moving home can be complex, especially when dealing with mortgage lenders or being part of a chain. Our service is designed to keep things running efficiently while quickly addressing any issues that arise.

We work with clients across the UK, offering trusted advice at every step.

- Call: 0115 870 9520

- Email: [email protected]

FAQs

Q

My current mortgage has an Early Repayment Charge period that ends after my intended moving date. What should I do?

A

Q

How does a remortgage differ from a home mover mortgage?

A

A remortgage is when you replace your existing mortgage with one lender to one with another lender on the same property, perhaps to get a better deal or to borrow more money. If you transfer your existing mortgage terms to your onward purchase that is called porting. A home mover mortgage is a term to describe a new mortgage taken out by a home mover on their onward purchase.

When borrowing more money please note you should think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Q

Why should I use a broker for a home mover mortgage?

A

Using a mortgage broker as part of your property move can be beneficial and save time. The broker will be able to assess your exact situation and offer realistic and advantageous options. Many people choose to use a broker as part of a property move due to the additional and ongoing support provided during what is a complex process.

Q

Can I move home if I’m still on a fixed-rate mortgage?

A

Yes, but it depends on your mortgage terms. You may be able to port your existing mortgage to your new property, which could help avoid early repayment charges. If porting isn’t an option, you may need to pay an exit fee or switch to a new mortgage. Our advisers can help you assess your options and find the best solution.

Q

How much deposit do I need for a home mover mortgage?

A

The deposit requirement varies depending on your circumstances and lender criteria. If you have equity in your current home, this can be used towards your deposit. Typically, lenders require at least 5–10%, but a higher deposit can help secure more advantageous mortgage rates.

Q

What happens if my house sale is delayed, but I’ve already secured a mortgage for my new home?

A

If there’s a delay in selling your current home, your mortgage offer may still stand for a set period, usually between three to six months. However, you may need to reapply if the delay extends beyond this. Our team can help you navigate these situations to keep your move on track.

Q

Should I choose a new mortgage deal or port my existing one?

A

This depends on your current mortgage terms, interest rates, and any fees involved. Porting can be beneficial if your existing mortgage has favourable terms, but switching to a new deal might offer more advantageous rates or flexibility. We’ll guide you through the pros and cons to help you decide.

Q

How does being in a chain affect my mortgage application?

A

Being part of a property chain can introduce delays but doesn’t directly affect your mortgage approval. However, if a sale falls through elsewhere in the chain, it could impact your move. Our advisers can help you prepare for potential setbacks and explore backup options.

Q

What extra costs should I budget for when moving home?

A

In addition to your deposit and mortgage payments, you may need to budget for stamp duty, valuation and legal fees, removal costs, and potential early repayment charges if switching lenders. We’ll help you factor in all costs so you’re financially prepared.

£65.5 billion

in gross mortgage advances were made in Q3 2024*.

This is an 8.9% increase from the previous quarter, highlighting that the property marketing is still active and improving.

*Source: https://www.fca.org.uk/data/mortgage-lending-statistics

"I'm proud to work on a team that places clients' needs at the forefront. Along with my colleagues, we strive to deliver top-tier mortgage solutions."

Sarah brings a wealth of expertise and a genuine passion for helping clients achieve their homeownership dreams. Her dedication and in-depth knowledge make the journey of securing a mortgage a smoother and more informed process.

- Call: 0115 870 9520

- Email: [email protected]

Reuniting a family after bereavement

Client background: Due to a bereavement, the decision was made for a family to move back in together. As a family, they wanted to make the move as soon as possible but the move involved one party moving from rented accommodation, one party selling their current property and all parties purchasing a property together.

The challenges:

- They wanted to sell and move as quickly as possible.

- The bereaved was no longer working and only in receipt of state pension.

- The bereaved wanted to gift the deposit for the new property from the proceeds of the sale of their property but also wanted to live in the new home.

What we did:

- We spoke to the client about the different sale schemes certain new build developers offer, including Part Exchange and Assisted Move.

- After a detailed initial consultation with the clients, we presented to them the option of Joint Borrower Sole Proprietor.

To wrap it up: To be eligible for the Part Exchange scheme, the seller of the Part Exchange property needed to be on the mortgage application for the new property. The age of the bereaved meant that the mortgage term was limited to nine years. To fix the problem, we applied for a Joint Borrower Sole Proprietor mortgage, meaning that all three family members would be on the mortgage application. As affordability was good, we didn’t need to use the pension income, which then meant that we could base the mortgage term on the younger applicant’s maximum age. This kept repayments manageable and got everyone into their new home without having to worry about selling privately.

This is for illustrative purposes only and does not constitute financial advice

We applied for a Joint Borrower Sole Proprietor mortgage, meaning all three family members would be on the mortgage.

What our customers say

I have used James Leighton three times now, each time they have been thorough and helpful. They are easy to contact and explain everything in detail. We will definitely come back if we move house again. Thank you